Unknown Facts About Tulsa Bankruptcy Legal Services

Unknown Facts About Tulsa Bankruptcy Legal Services

Blog Article

The 6-Second Trick For Affordable Bankruptcy Lawyer Tulsa

Table of ContentsThings about Chapter 13 Bankruptcy Lawyer TulsaThe Ultimate Guide To Tulsa Bankruptcy Legal ServicesThe smart Trick of Tulsa Bankruptcy Filing Assistance That Nobody is Talking AboutTulsa Bankruptcy Consultation Fundamentals ExplainedThe Of Tulsa Bankruptcy Filing Assistance

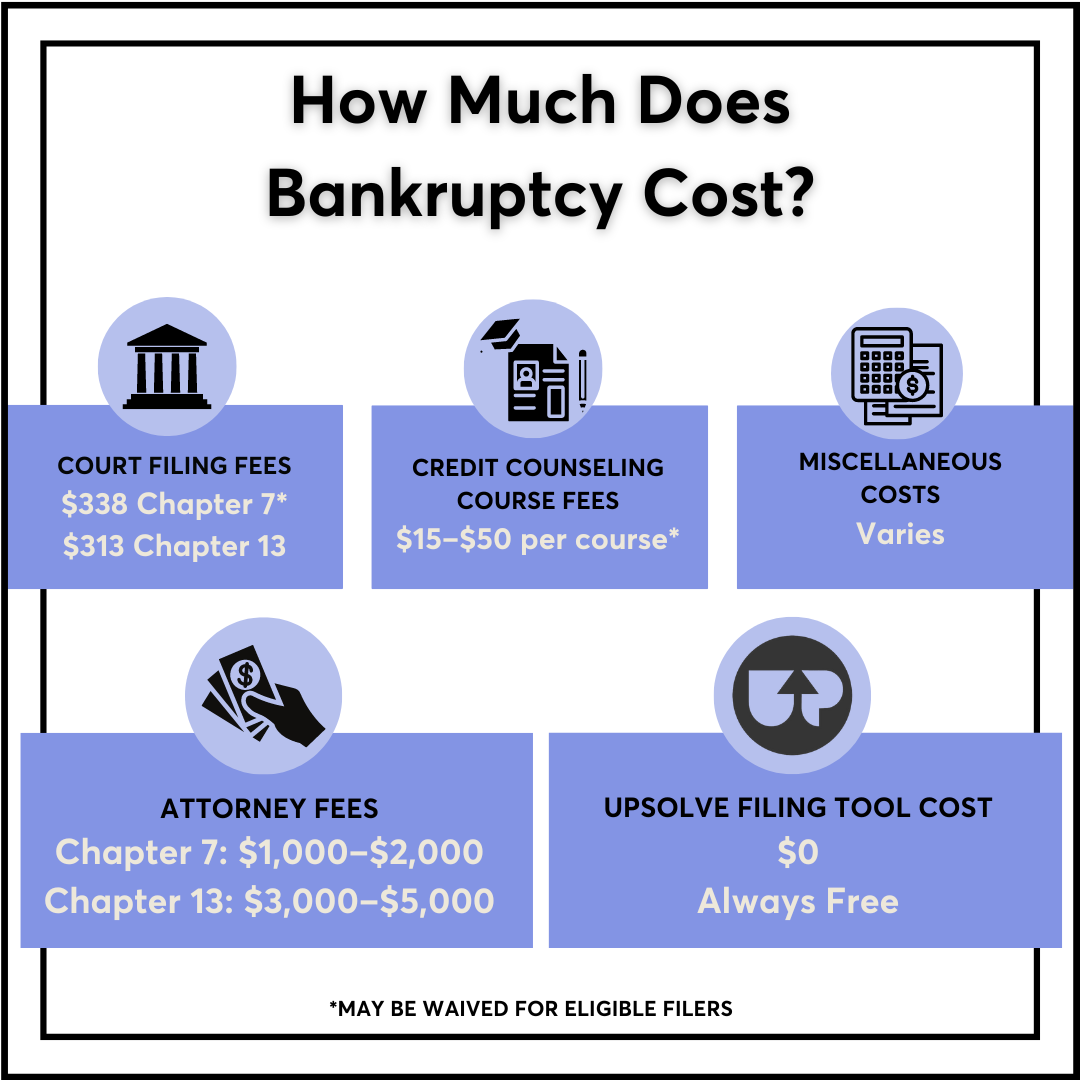

The statistics for the various other primary kind, Phase 13, are even worse for pro se filers. (We damage down the differences between the 2 enters depth listed below.) Suffice it to state, talk to a legal representative or 2 near you who's experienced with personal bankruptcy regulation. Below are a couple of resources to discover them: It's understandable that you could be reluctant to pay for a lawyer when you're currently under significant economic stress.Numerous lawyers additionally provide free consultations or email Q&A s. Take benefit of that. (The non-profit app Upsolve can help you find totally free assessments, resources and legal help for free.) Ask if bankruptcy is certainly the right choice for your circumstance and whether they think you'll qualify. Prior to you pay to submit insolvency types and blemish your credit scores report for approximately 10 years, examine to see if you have any feasible choices like financial obligation negotiation or non-profit credit report therapy.

Advertisements by Money. We may be compensated if you click this ad. Ad Since you've determined personal bankruptcy is undoubtedly the right strategy and you hopefully cleared it with an attorney you'll require to start on the documentation. Prior to you study all the official personal bankruptcy forms, you need to obtain your very own records in order.

Tulsa Bankruptcy Attorney Can Be Fun For Everyone

Later down the line, you'll in fact need to prove that by revealing all kind of details concerning your financial affairs. Here's a basic list of what you'll require when driving ahead: Identifying papers like your chauffeur's license and Social Security card Income tax return (approximately the past 4 years) Evidence of income (pay stubs, W-2s, self-employed revenues, revenue from possessions as well as any kind of earnings from federal government benefits) Bank statements and/or retirement account statements Evidence of worth of your assets, such as automobile and property evaluation.

You'll wish to understand what sort of financial obligation you're trying to resolve. Debts like youngster support, alimony and specific tax financial debts can not be released (and insolvency can not stop wage garnishment relevant to those debts). Trainee car loan financial debt, on the various other hand, is possible to discharge, however keep in mind that it is difficult to do so (bankruptcy lawyer Tulsa).

You'll wish to understand what sort of financial obligation you're trying to resolve. Debts like youngster support, alimony and specific tax financial debts can not be released (and insolvency can not stop wage garnishment relevant to those debts). Trainee car loan financial debt, on the various other hand, is possible to discharge, however keep in mind that it is difficult to do so (bankruptcy lawyer Tulsa).If your earnings is also high, you have another option: Phase 13. This option takes longer to resolve your financial obligations due to the fact that it needs a long-term payment strategy normally 3 to 5 years before a few of your continuing to be financial obligations are wiped away. The declaring process is additionally a whole lot extra intricate than Phase 7.

About Tulsa Ok Bankruptcy Attorney

A Chapter 7 bankruptcy remains on your credit scores report for 10 years, whereas a Phase 13 insolvency drops off after seven. Before you send your personal bankruptcy types, you need to first finish a mandatory training course from a credit counseling company that has actually been approved by the Division of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The course can be finished online, in individual or over the phone. You need to finish the course within 180 days of filing for insolvency.

Some Known Details About Top Tulsa Bankruptcy Lawyers

A lawyer will generally manage this for you. If you're filing by yourself, understand that there are concerning 90 various personal bankruptcy areas. Inspect that you're filing with the proper one based on where you live. If your irreversible house has moved within 180 days of filling, you ought to submit in the district where you lived the greater section of that 180-day period.

Normally, your personal bankruptcy attorney will certainly collaborate with the trustee, however you may need to send the individual files such as pay stubs, tax obligation Tulsa OK bankruptcy attorney returns, and savings account and debt card declarations straight. The trustee that was just appointed to your case will certainly quickly set up a necessary conference with you, referred to as the "341 conference" since it's a need of Section 341 of the U.S

You will require to give a prompt try this out list of what qualifies as an exception. Exceptions might put on non-luxury, primary cars; required home goods; and home equity (though these exemptions guidelines can differ extensively by state). Any kind of residential or commercial property outside the checklist of exceptions is thought about nonexempt, and if you do not give any type of checklist, then all your residential or commercial property is taken into consideration nonexempt, i.e.

You will require to give a prompt try this out list of what qualifies as an exception. Exceptions might put on non-luxury, primary cars; required home goods; and home equity (though these exemptions guidelines can differ extensively by state). Any kind of residential or commercial property outside the checklist of exceptions is thought about nonexempt, and if you do not give any type of checklist, then all your residential or commercial property is taken into consideration nonexempt, i.e.The trustee would not market your cars to instantly pay off the creditor. Rather, you would certainly pay your lenders that amount over the program of your payment strategy. An usual mistaken belief with insolvency is that once you submit, you can quit paying your financial debts. While personal bankruptcy can assist you eliminate much of your unprotected financial debts, such as past due clinical expenses or individual lendings, you'll intend to keep paying your monthly settlements for secured financial debts if you desire to keep the building.

Chapter 7 Vs Chapter 13 Bankruptcy Things To Know Before You Get This

If you go to threat of repossession and have exhausted all other financial-relief options, after that filing for Chapter 13 might delay the repossession and conserve your home. Inevitably, you will still need the revenue to continue making future home loan settlements, along with paying off any type of late settlements over the program of your repayment strategy.

If so, you may be called for to provide additional information. The audit might postpone any financial debt alleviation by a number of weeks. Naturally, if the audit shows up wrong information, your situation can be dismissed. All that claimed, these are rather rare circumstances. That you made it this far at the same time is a good sign at the very least a few of your financial debts are eligible for discharge.

Report this page